A good friend of mine has an email signature that includes the quote, “Everyone wants to be unique, but no one wants to be different”.

It can be a little scary being different. We open ourselves up to judgement by others. Young people often experience criticism or ridicule by school mates when they don’t fit in.

Being different also takes more work. It’s easy being the same and it doesn’t take any creativity or courage to be just like everyone else.

When we look at competitors in an industry, the same can be said. It doesn’t take much creativity or courage to be the same as every other player in the industry. But this approach, an undifferentiated strategy, is rarely a recipe for long-term success. Conversely, players in an industry whose offerings are significantly different have a huge advantage that can have significant financial benefits.

Pricing math

A colleague here at Results recently directed me to a research study looking at pricing strategies. According to this research, a 2% increase in price for the companies studied translated into as much as a 14% increase in operating profitability.

It works the other way too. Discounting even a small percentage can have a significant negative impact on profitability. To illustrate, if a firm has a product line with a 40% gross margin, a discount of 20% means that firm has to sell twice the volume to maintain the same profit contribution.

But the ability of a company to increase prices, or the need to discount, has everything to do with how differentiated its products or services are.

Can you increase your prices?

What would the impact be of increasing your prices? Would you be worried about losing a significant number of clients or revenue?

According to Warren Buffett, “If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10%, then you’ve got a terrible business.”

Pricing power is directly related to differentiation. Competitors whose products and services are meaningfully different from their competition have pricing power. Those who offer the same as other players do not have pricing power and must discount as their default approach to competition.

Apple versus PC is a good example; I can buy a PC running the Windows Operating System from a variety of different suppliers including Dell, Levono, Samsung, etc. These competitors have less ability to increase prices than Apple simply because buyers can only buy a Mac computer from Apple. The Apple offering, including its own proprietary operating system, is significantly different from its competitors’ offerings.

Sources of differentiation

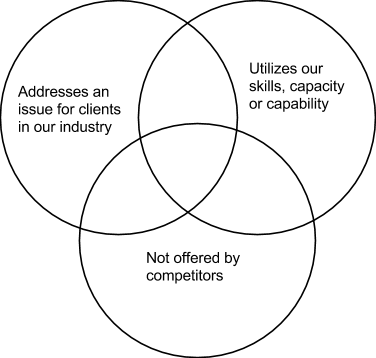

Finding meaningful opportunities for differentiation is a creative process, but ideas can be evaluated in a structured way by considering three key questions:

- What challenges, friction or headaches do our clients have relating to products and services in our industry? How does the idea solve these?

- What resources, capabilities or expertise do we have (or could we add)

that is untapped? - Is this something our competitors are already doing, or would this offering be unique to us?

Number 1 is the most important, and we would recommend regularly getting feedback from customers through Net Promoter Surveys, Voice of the Customer sessions and asking good questions during one-on-one conversations with clients.

One of our clients is a service company to the Oil and Gas Industry, and much of their work is construction projects. In speaking to the CEO, he shared with me a recent move they made to ‘insource’ project management and controls and provide that as an add-on service to their clients. This alleviated a significant burden that their customers had which none of the competitors were offering, and has already resulted in new revenue and the ability to increase price. This is a differentiated offering that meets all three criteria.

Bottom-line benefits

With a differentiated offering, business leaders have choice. They can choose to increase pricing to see what the market will bear, or leave pricing on par with competitors and benefit from winning more new business. Or somewhere in between. In either case differentiation becomes the source of higher revenue, profitability and success.

Article by Tim O’Connor